Business operations

The group's own business is investment, in which Private Equity funds are the most significant asset class. Other important asset classes are listed stocks and listed equity funds, ETF products, hedge funds, equity or bond derivatives.

The cornerstone of the company's operations is investment research. Nothing is done and nothing is started without research. Knowledge and expertise are the company's most important tools. Another cornerstone is risk management, in which the decentralization of investments plays a key role.

The company's investment activities have continued throughout it's history, with varying values. Once operational activities have been discontinued, the investment activities are permanent.

The company has values in its investment operations, where responsible investment is an important part of Berling Capital Oy's values. Responsible investment standards are abided to when making investment decisions. As a company, we trust the promises of sustainability made by the trusts.

Private Equity Investment

The investment history of Berling Capital Oy (BC) began almost 40 years ago, when we started to make PE investments with our own capital, during which time the capital of the current investment was created. After 30 years, in 2014, all operating companies with 100% or majority ownership were sold, with a workforce of around 700 personnel. The decision was made to start investing in PE funds.

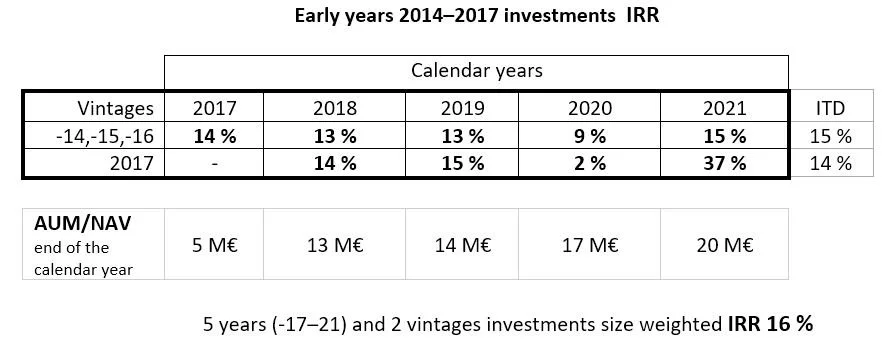

First period, Early years 2014–2017

The operations started in autumn 2014 by familiarizing ourselves with a foreign industry, PE fund investments in a foreign industry, and although we were familiar with PE operations, we did not know international PE fund operators ie GPs. We went to meet the GPs in different countries, made connections and made investments that were big for us but small within the industry. In the first three years of 2014–2016, the annual number of investments was so small that the figures are not considered in separate calendar years, but the first three years are collectively called vintage -14, -15, -16. The following year, called vintage 2017, we dared to increase the number of entries as well as to increase their size. In the early years, there were also Finnish PE funds within these entries, and in general the focus on Europe was much higher than in the following years. Below is a table detailing the success of the investments in this first period.

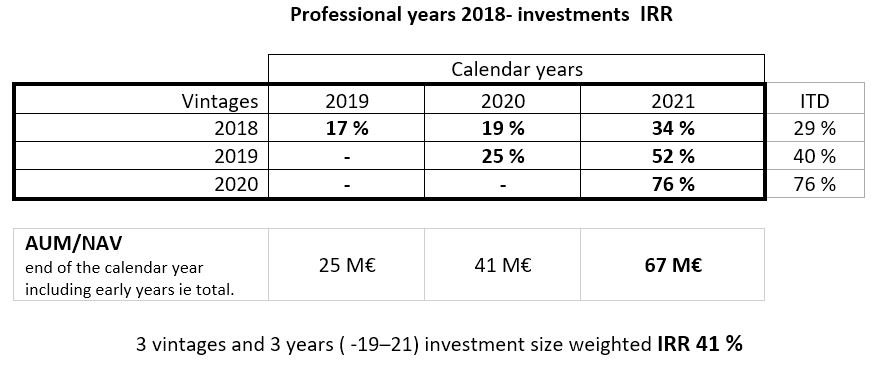

Second period, Professional years 2018 – ongoing

In the autumn of 2017, it was decided that we would invest more in operations, hire more staff and increase our research activities, form two PE investment database contracts, Preqin and Pitchbook, which provided necessary information for making investments. Towards the end of 2017, making investments gained a more professional touch along with it's own PE investment strategy, which was practiced and learned over the previous three years. The weight of the United States in the markings rose to 70%. Investing in the activity generated a return that is reflected in the IRR numbers compared to the first years. The realized IRR increased from the early years' 16% to 41%.

The volume-weighted return for the first years was 16% and for the following years 41%. Volume-weighted means that the sum of the returns of each year's fund has taken into account how much money was invested in it. This means that the early years and the small funds weigh less in this calculation. Here is the entire history of the company PE fund investments, the total return of all funds is 31%.

At the end of 2021, the situation is that there are investments in 53 different funds, there are more than 50 active GP (general partner) connections and the NAV of the investments is 67 million € on 31 December, 2021. The investments made have been found to be correct and the total exclusion of Asia and the rest of the world has proved to be a successful choice. In PE investment, work-intensive decentralization has been one of the cornerstones of high returns. PE's selection as the main investment type has also been successful for the company. The company made a profit of 20 million € in 2021 alone, although the year was exceptional. The volume-weighted IRR for all PE years is 31%. In comparison, in the last five years (2017–2021) S&P 500 has produced a total of little over 100%, i.e. IRR p.a. is approximately 16% and in the same years Eurostoxx 600 is approximately 35%, i.e. IRR p.a. is approximately 6%, and the combination of these with the same US-EUR weight of 70-30%, which we now have in PE has in these 2 indexes have produced the abovementioned 5 years an IRR of 13% and our PE investments in the same five years (2017–2021) have generated an IRR of 34%. We are an investor in more than 500 companies, which is our diversification in this investment category. The plan is to build a investment portfolio of well over 100 million € PE, well-diversified in terms of time, geography and operations.

Confedent International

Confedent International is Finland's largest professional congress organizer (PCO), i.e. a full-service congress services company. Confedent organizes congresses and meetings for its international and national clients in Helsinki and elsewhere in Finland. The company is active in Helsinki meeting marketing internationally, which is one of the company's important values. Berling Capital founded the company in 1996 and has grown to its present size through acquisitions and organic growth. The congresses organized by the company have been attended by approximately 120 000 participants. The company's business has been in low gear since spring of 2020 due to the Covid epidemic. Operation is reactivating during 2022. The results of the company's customer satisfaction surveys have been excellent.

For more information, please visit Confedent International.